In the complex world of debt and finance, the Fair Debt Collection Practices Act (FDCPA) stands as a crucial safeguard for consumers against unfair and abusive debt collection practices. Enacted in 1977, this federal law sets clear guidelines for debt collectors and provides important protections for individuals facing debt collection. Let's delve into the purpose, protections, and real-world implications of the FDCPA.

Purpose of the FDCPA

The primary goal of the FDCPA is to eliminate abusive practices in the collection of consumer debts. It promotes fair debt collection and provides consumers with an avenue for disputing and obtaining validation of debt information. The Act applies to personal, family, and household debts, including money owed on credit card accounts, auto loans, medical bills, and mortgages.

Key Protections for Consumers

Communication Restrictions:

Debt collectors cannot contact debtors at inconvenient times, typically before 8 a.m. or after 9 p.m.

They must cease communication if the consumer requests it in writing.

Workplace Limitations:

Collectors cannot contact a debtor at their place of employment if they know the employer prohibits such communications.

Third-Party Contact Restrictions:

Debt collectors may only contact third parties to obtain location information about the debtor.

Harassment and Abuse Prohibition:

The use of threats, violence, or obscene language is strictly forbidden.

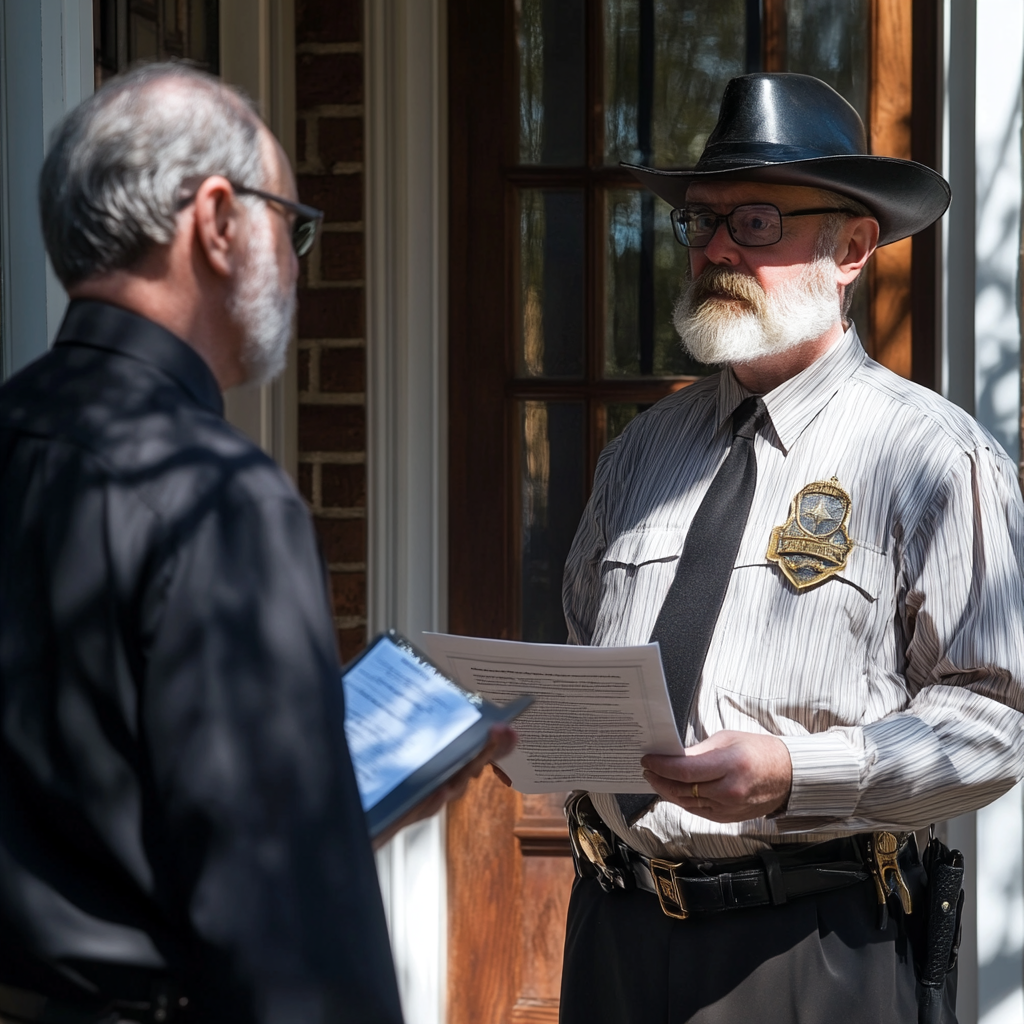

False or Misleading Representations:

Collectors cannot use deceptive practices to collect a debt, such as impersonating law enforcement.

Unfair Practices:

Collectors are prohibited from using unfair means to collect a debt, like threatening property seizure without proper authority.

Debt Validation:

Consumers have the right to request validation of the debt within 30 days of initial contact.

Real-World Examples and Consequences

Example 1: Excessive Phone Calls

A collection agency repeatedly called Sarah, a debtor, multiple times a day, including late at night. This violates the FDCPA's communication restrictions. Sarah filed a complaint, resulting in the agency facing fines and being required to implement stricter compliance measures.

Example 2: False Representation

John received a letter from a debt collector claiming to be a government official, threatening arrest for unpaid debts. This false representation is a clear violation of the FDCPA. John reported the incident, leading to legal action against the collection agency and compensation for John's distress.

Example 3: Workplace Harassment

A debt collector contacted Emily's employer about her outstanding debt, despite being informed that such calls were prohibited at her workplace. This violation led to a successful lawsuit, resulting in statutory damages for Emily and a hefty fine for the collection agency.

Consequences for Violations

Debt collectors who violate the FDCPA can face serious consequences:

Statutory Damages: Up to $1,000 per violation.

Actual Damages: Compensation for any financial losses or emotional distress caused.

Attorney's Fees: Violators may be required to pay the consumer's legal fees.

Class Action Lawsuits: For widespread violations affecting multiple consumers.

Regulatory Action: The Federal Trade Commission (FTC) or Consumer Financial Protection Bureau (CFPB) may take action against repeat offenders.

Impact on Debt Collection Practices

The FDCPA has significantly impacted the debt collection industry:

Increased Compliance: Collection agencies have implemented strict compliance programs to avoid violations.

Consumer Empowerment: Debtors are more aware of their rights and more likely to report violations.

Debt Negotiation: The Act has encouraged more ethical approaches to debt settlement and negotiation.

Bankruptcy Considerations: FDCPA violations can influence a debtor's decision to file for bankruptcy as a means of protection.

While the FDCPA provides robust protections, consumers should still be proactive in understanding their rights and obligations regarding debt. If you're facing aggressive collection practices or suspect a violation of the FDCPA, consider seeking legal advice or filing a complaint with the CFPB.

Remember, knowledge of your rights under the FDCPA can be a powerful tool in managing debt and dealing with collection agencies. Stay informed, document any potential violations, and don't hesitate to assert your rights as a consumer.

Disclaimer: This blog post is for educational purposes only and does not constitute legal advice. If you're facing debt collection issues, please consult with a qualified attorney for advice tailored to your specific situation.